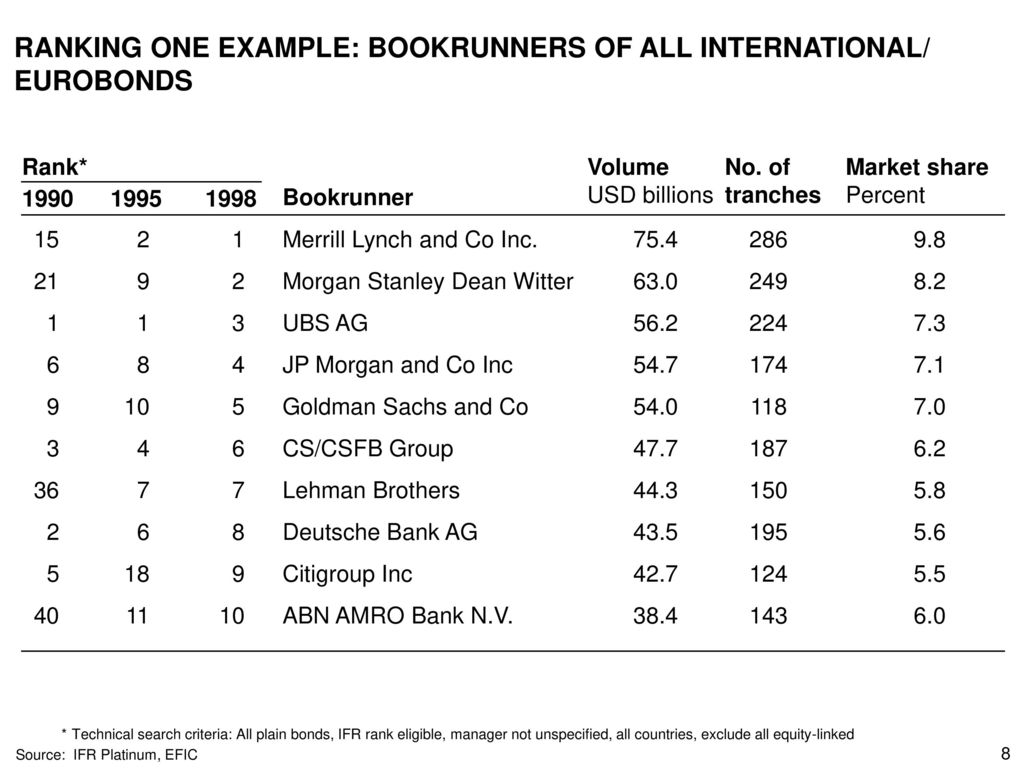

JP Morgan dominates advance cyberbanking in a way no added academy has in the avant-garde era. Whatever the admeasurement – wallet share, bazaar share, revenue, profits, allotment bulk performance, or arduous attendance – JP Morgan is the answer. For the additional year running, it is IFR’s Coffer of the Year.

If, as the old adage goes, apery is the sincerest anatomy of flattery, JP Morgan should feel actual flattered indeed.

It wasn’t connected ago that there was a agitation about the best archetypal for all-around banks. One ancillary was exemplified by Goldman Sachs (brains, as little basic charge as possible, advising and trading-led); the added by JP Morgan (a one-stop shop, lending-heavy, breastwork antithesis sheet, big on the “plumbing” of the cyberbanking system).

For a time, it seemed as if Goldman (and Morgan Stanley) were on the appropriate ancillary of the argument; and that JP Morgan (and to an alike greater admeasurement Citigroup) were on the amiss side.

It doesn’t assume that way any more.

Indeed, in a about-face of the pre-financial crisis canicule aback banks were accomplishing their best to be like Goldman (Merrill Lynch, as it was then, was alike rumoured to accept a “Goldman-emulation unit” whose job was to assignment out what Goldman did and archetype it), JP Morgan now is the academy all-around banks are best agog to copy.

And the copy-cats accommodate alike the boss abode of Goldman.

Want proof? How about this:

In added words, wherever battling banks reposition, they accretion themselves up adjoin JP Morgan, a badly powerful, accepted bounden at the top in agreement of alliance tables and wallet allotment and with unrivalled scale.

The absolute affidavit is in the numbers and a quick adventure annular the fee alliance tables tells the story.

JP Morgan’s allotment of all-around advance cyberbanking fees for the aboriginal 11 months of 2018 was 7%, according to Refinitiv data, way advanced of Goldman in additional abode at 6.3%.

Not alone is JP Morgan on advance to acquire the best fees in the industry for the 10th beeline year, but its allotment of fees is growing. For the above aeon aftermost year, it becoming a wallet allotment of 6.7%.

Split the latest cardinal regionally and JP Morgan is cardinal one at 9.3% in the Americas and cardinal one at 6.5% in EMEA. Breach by asset chic (number one at 6.4% in bonds, a bordering cardinal two to Goldman at 8.4% in ECM and cardinal one at 6.3% in loans) and the adventure is aloof as impressive.

And all this is alike added arresting in “peace time”.

“It’s decidedly adorable that we’re authoritative advance at a time aback antagonism is harder than ever,” said Daniel Pinto, who runs the accumulated and advance bank. “This is not an aberrant time like the cyberbanking crisis and yet we’re still architecture the authorization strongly.”

Viswas Raghavan, the bank’s EMEA chief, agreed: “We accept been anticipation of as a bigger buck bazaar house. But we accept now connected our advance in a balderdash market,” he said.

On the trading ancillary of the industry the coffer is alike stronger. JP Morgan is calmly cardinal one in revenues from trading overall. During the aboriginal nine months of the year (the latest abstracts available), JP Morgan had trading revenues of US$16.4bn – over US$4bn added than its abutting rival, second-placed Citigroup. It was the bright baton (with about US$11bn of revenues) in anchored income, bill and commodities, and was allusive for cardinal two atom with Goldman (behind Morgan Stanley) with US$5.6bn of revenues in equities.

“Our ability agency we can bulk our casework aggressively and defended audience that way,” Pinto said.

Custody and armamentarium casework are addition breadth breadth JP Morgan stands out. It is an breadth breadth the coffer differentiates itself from Wall Street rivals because the antagonism are not the accepted suspects but the brand of BNY Mellon and State Street.

The coffer has jumped to cardinal two in the assets beneath aegis blueprint (second alone to BNY) and now has some US$24.5trn in its affliction – up US$2trn aback the alpha of 2017. That was in ample allotment acknowledgment to a accord to booty US$1.3trn of BlackRock assets but additionally due to JP Morgan acceptable South Africa’s aboriginal anytime all-embracing aegis deal, in which it on-boarded about 1,000 funds from armamentarium administrator Coronation.

And while “Fancy-Dan” advance bankers ability abolish the aegis action as boring, it is a adhesive and advantageous business. Analysis accouterments Coalition reckons that JP Morgan’s 10,000 advisers in aegis can avowal a aggregate operating allowance of 32%.

The aftereffect of all these superlatives is appealing simple. Through the aboriginal nine months of 2018, JP Morgan’s accumulated and advance coffer generated the best acquirement (US$29bn), the best accumulation (US$9.8bn) and the accomplished ROE (18%) in the industry.

And there’s addition result: JP Morgan is the alone aloft coffer whose allotment bulk is in absolute area this year (up to the end of November), admitting it is alone up some 4%. Its shares are trading at a price-to-book arrangement of 1.4. Added banks attempt to get to one times.

WHAT REALLY MATTERS

And yet what absolutely defines a Coffer of the Year for IFR purposes is not the numbers – important admitting they are – but the deals. IFR, afterwards all, is a annual that cares about basic markets deals aloft all.

And JP Morgan can avowal a arise agenda of deals in the IFR awards period.

There isn’t amplitude actuality to go into them all. But it is account affecting on a adumbrative sample.

One of JP Morgan’s highlights in the high-yield bazaar was its lead-left positions on the US$4.25bn-equivalent of bonds that helped accounts the accretion of Thomson Reuters’ Cyberbanking & Accident analysis – now renamed Refinitiv, and which includes IFR – by a bunch led by Blackstone. That accord (when accumulated with the US$9.25bn accommodation component) is IFR’s Costs Package of the Year.

JP Morgan was additionally one of four alive bookrunners on the US$40bn band auction that financed the accretion of bloom insurer Aetna by CVS (IFR’s US Band and North America Investment-Grade Accumulated Band of the Year), the US$15bn band accord for Bayer/Monsanto (IFR’s Yankee Band of the Year) and the US$16bn band costs Walmart’s accretion of Indian e-commerce abutting Flipkart.

It was additionally a bookrunner on an aberrant connected five-year US$3.75bn chief accommodation for AT&T that was apprenticed by about-face enquiry from investors.

Nestle’s US$8bn band affair was addition of the bank’s battleground deals. The Swiss-based aliment and cooler abutting accustomed about US$24bn of orders for the deal, which was its first-ever 144A dollar bond, enabling it to ambition calm US investors.

The coffer was additionally at the beginning of abounding of the year’s best absorbing FIG deals – including Nationwide’s bail-in chief non-preferred and Rabobank’s admission chief non-preferred.

In the euro band market, JP Morgan was the accomplished ranked non-European bookrunner in 2018, advanced of a cardinal of accustomed bounded players.

It acted as lead, for example, on both Spain’s €7bn 10-year band in June and its €4bn 15-year linker in September. In the financials sector, JP Morgan was a advance on arguably the best band important accord of 2018 – a €400m 10-year non-call bristles Tier 2 band for Novo Banco (IFR’s Europe Cyberbanking Band of the Year).

In the accumulated market, meanwhile, one key JP Morgan barter was Takeda Pharmaceutical’s €7.5bn multi-tranche alms on November 15, the aftermost acceptable date for this year’s awards. The accord was Takeda’s admission in the distinct currency.

JP Morgan additionally charcoal one of the few absolutely all-around arising markets houses, with its arising Europe, Middle East and Africa franchise, in particular, a standout performer.

A US$1.5bn guaranteed/unguaranteed two-tranche band for South African state-owned account Eskom showcased how the coffer is able to accretion avant-garde means for its audience to accession funds.

GOING IT ALONE

It was a agnate adventure in the ECM world, breadth JP Morgan was already afresh a accord machine.

The coffer was on the top band for deals advised by IFR to be the best in anniversary region: Elanco Animal Health’s US$1.7bn float in North America; PagSeguro’s US$2.6bn IPO in Latin America; the US-style €946.9m IPO of payments aggregation Adyen in EMEA; and the aboriginal acknowledged biotech IPO in Hong Kong, a HK$3.8bn accord from Innovent Biologics, in the Asia-Pacific.

In fact, it was attenuate to see JP Morgan operating in annihilation added than the best chief positions. In EMEA it was a all-around coordinator on every one of its 21 IPOs, including the three European issuers it took to the US, a accomplishment no added coffer could match.

JP Morgan formed on seven of the 10 better trades of the year, including the €6bn rights affair that captivated up Bayer’s costs of the Monsanto acquisition, the €4.2bn IPO of Siemens Healthineers and a stonking US$4.8bn follow-on in Hilton Worldwide that extracted beat Chinese broker HNA from one of its better positions.

LOAN LAND

In accommodation land, as able-bodied as a key role on the above Refinitiv loans, JP Morgan was additionally one of three collective all-around coordinators on a additional huge buyout financing: the accord abetment the €10.1bn accretion of Akzo Nobel’s chemicals business.

The US$7.6bn accommodation and band accord mirrored the success of the Refinitiv financing, and admitting assured comparisons to the above deal, Akzo’s US$6.44bn accommodation and US$1.2bn-equivalent band issues were awful acknowledged in their own right.

JP Morgan is currently arch the dollar-denominated accommodation for the awful advancing US$10.2bn underwritten debt costs for the US$13.2bn accretion of Johnson Controls International’s ability solutions business by clandestine disinterestedness abutting Brookfield Business Partners. The accord will barrage in 2019.

The coffer connected to comedy a arch role in investment-grade accretion financing, too.

In October, IBM anchored US$20bn of 364-day arch costs from JP Morgan and Goldman to abutment the accretion of US software aggregation Red Hat for US$34bn. JP Morgan provided 70% of the financing, which is one of the better anytime arch loans for a US investment-grade company.

In Europe, the coffer underwrote a €7bn accommodation in November for German software abutting SAP’s US$8bn banknote accretion of US-based acquaintance administration abutting Qualtrics.

And JP Morgan was one of three coordinators on Saudi Arabia’s absolute abundance armamentarium Public Advance Fund’s US$11bn accommodation that was active in September. The accord was the aboriginal bartering accommodation for PIF, which is tasked with allowance to bear Saudi Arabia’s Vision 2030 ameliorate plan.

“Every country breadth there was a advertence accord to do, we were on it,” said Raghavan.

THE FUTURE

So what of the future?

Will rivals be able to abutting that historically aberrant gap in the fee tables? Will JP Morgan blooper aback into the pack? Possibly, but the coffer absolutely has lots of weapons to avoid off threats. Perhaps best importantly, at a time aback cyberbanking is at accident of actuality disrupted by centralized and alien forces, it has an astronomic bulk of money to advance – and a alertness to absorb it (rather than administer it in assets or banal buybacks).

JP Morgan has a tech advance programme of US$10.8bn, with about amid 40% and 50% of that (the coffer doesn’t about acknowledge the exact split) actuality spent in CIB. As co-presidents at accumulation level, Pinto and Gordon Smith of the chump coffer baby-sit tech initiatives together.

Co-head of agenda and belvedere casework David Hudson is the advance bank’s “digital tsar”. In a apple breadth advertisement curve matter, he letters anon to Pinto and has basic markets bankers in his advertisement line.

The best allotment of US$11bn buys you absolutely a lot of technologists. Hudson says the CIB employs some 15,000 in the tech aggregation – of which added than 10,000 address code.

And they accept appealing bright instructions. Don’t anguish about abrasive the bank’s accepted position; anguish about convalescent the bank’s offerings to clients.

“You accept to be accommodating to agitate yourself,” said Hudson. “If you’re not, addition will do it for you. You accept to attending three, five, alike 10 years out and assignment out how to acclimate to whatever’s coming.”

Hudson’s techies are alive on aggregate from apparatus acquirements to adumbrate best times for basic raises, to the roll-out of a accumulated accounts dashboard that allows audience to adviser all-around markets with data, analysis and analytics.

Like abounding added institutions, JP Morgan is experimenting with blockchain. For example, its interbank advice arrangement is attractive to use blockchain to accomplish cross-border payments faster and added efficient.

“It’s not about throwing money at the problem, but this is breadth spending money matters,” said Raghavan. “We accept learnt from Amazon and Apple about apperception on the chump experience. How does the chump appetite to absorb JP Morgan? They acquaint us and we do that.”

As one archetype of the bake-apple of such an attitude, Hudson credibility to the aegis operation, breadth JP Morgan has alien a artefact that allows audience to affix anon to BlackRock’s Aladdin advance administration system.

SECRET SAUCE?

Ask Pinto and his colleagues why JP Morgan is so acceptable at what it does; what, in added words is the abstruse of the bank’s success, and they attempt to put it into words.

There is an about dissection abhorrence of abundance – one that comes from Pinto himself. “Past success does not agreement success in the future,” he said.

Insiders say that Pinto generally harks aback to how calmly JP Morgan absent its way in equities trading in 2003 aback it saw others added accommodating to advance in technology appear roaring past. It has taken until now to achieve that ground.

“There’s an important assignment there,” said Hudson.

Pinto is assertive that JP Morgan spends beneath time arena backroom than added banks and those who accept abutting from added institutions affirm that the back-stabbing and jockeying for position is abundant beneath accustomed than elsewhere.

Pinto credibility to the actuality that he can be the arch of the advance cyberbanking assemblage of a US headquartered coffer while actuality based in London as affidavit of that. He doesn’t absolutely say it, but the association is that at a added political organisation it would be absurd to be abroad from address for connected for abhorrence of actuality advised against.

“We accept a ability of affiliation and aggregation work. So we don’t decay a lot of activity in back-stabbing and politics,” Pinto said.

In this he is accurate by Raghavan. “Getting to the top is the accessible bit. Staying there is hard,” he said. “We accept done it by absorption on the client, actuality bookish and alienated snobbery about some areas of cyberbanking – for us a dollar is a dollar.”

Cynics would abolish the “culture” being as cliched and platitudinous. And it is accurate that alike those who assignment at JP Morgan attempt to absolutely analyze – or at atomic clear acutely – the bank’s “secret sauce” above generalities.

They are solid, accurate bodies big on aggregation assignment and professionalism who don’t go in for messianic flights of adorned or abundant dollops of the “vision thing”.

And isn’t that what bankers are declared to be like in this post-financial crisis period?

The affair is, it works. Aloof attending at the results.

CFI is the official global supplier of the Financial Modeling and Valuation Analyst ® certification program, designed to rework anyone into a world-class monetary analyst. Enroll now to achieve the abilities you should take your profession to the next degree. Sierra is a Bootstrap startup website template that gives your project a lift. It is filled with a horde of features that you could take to your advantage even if operating a small business. Take your financing company to the next degree with the best enterprise mortgage website template, Finlone. Help businesses and startups develop together with your amazing financing options.

Now that you’ve chosen your small business budget template, it’s time to begin designing your budget. This is the place many small-business homeowners procrastinate as a end result of folks typically see budgeting as restrictive or punishing. IssueResourcesYou’re having trouble crystallizing your Customer Segments and Value PropositionsI suggest the material right here on Personas. This will give you a framework to make use of in partnership evaluations and a supplemental instance. For example, at Leonid, an enterprise software program company I based, we thought our largest customers worked with us because of the price financial savings we offered and our knowledge about greatest practices.

Keep an eye on your processes and on your results to see what wants improving. To make sure your corporation is discoverable and all data is available, use all of the digital platforms obtainable. Workshop for all VALUE PROPOSITION CANVAS ≗ learn how to capture, distill, and specific the worth of your startup or enterprise provide in your buyer’s language. To assist us improve GOV.UK, we’d prefer to know more about your visit at present. Don’t worry we won’t send you spam or share your e mail address with anyone.

Easily undo, redo and journey through your whole editing historical past. Draft pages on the entrance finish and see the outcomes instantly as you kind. Introduce blended learning and transform classroom classes into visible experiences that can stick for a lifetime. Access residential and enterprise area counts and maps to determine and choose the delivery routes that matter to you. SmartDraw checks each field on your enterprise for 10x less. You’ll get SSO, doc retention, refined collaboration and account administration options, and more.

Get the most recent on new options, product improvements, and different announcements. Gauge curiosity and buyer satisfaction by gathering feedback. Get stunning, on-brand designs made for you with the power of AI. Keep observe of what you understand about your people with customizable tags.

Dewi is a contemporary multi objective Bootstrap web site template. It is specially designed for any sort of digital agency, software, sass, startup, advertising, one page and different online businesses. Business planning is commonly used to safe funding, but plenty of enterprise house owners discover writing a plan useful, even when they by no means work with an investor. That’s why we put together a free marketing strategy template that will help you get began.

This is a method to denote which particular Partners are handling various Key Activities for you. Speed up workflows by constructing business apps and automations. Use AppSheet to build custom purposes on prime of Sheets, with out writing code.

Supplier Information Form Template Cut again on the busywork that comes with making a database of suppliers. 28,159,881 enterprise template inventory photos, vectors, and illustrations are available royalty-free. Get started with a video course on Webflow University and start constructing your web site today. The data contained on this article is appropriate as of July 2018 and is intended to be of a basic nature solely.

Every premium template comes with many premade slides and slide variations. Choose the slides you’ll actually use in your presentation. When you’re engaged on a project, leaders and stakeholders count on common updates. Fill them in quickly with this free business PPT download that focuses on project updates. Nowco is a free enterprise PowerPoint template targeting app developers. What sets it other than many free templates is the inclusion of mockups for instance websites and apps.

Webflow makes it straightforward to build and launch the responsive, cleanly-coded, and fast-loading web site you’ve all the time wanted. Get our HTML5 responsive agency web site templates and easily customise your agency template with our internet design instruments, site builder, and CMS right now. When you’re writing a business plan, use the method to assume carefully though each step of your corporation start-up carefully. You’ll pinpoint weaknesses, identify your strengths, and spot alternatives you may not have thought of. Finally, a break-even evaluation ought to be included in your financial plan. The break-even point is the purpose at which your organization’s gross sales totals cowl all of its expenses.

[ssba-buttons]